Market

Pulse

Download the latest Market Pulse, our comprehensive office market report with in-depth analyses of the Sydney CBD and North Shore markets.

Market

Dashboard

A collection of data, charts and insights providing a succinct snapshot of the Sydney office leasing market.

Sydney

CBD

13.7%

Vacancy Rate

as at Jul-25

56,532

Net Absorption

12 months to Jul-25

1.2%

Rental Growth

A Grade net effective, 12 months to Jun-25

32%-42%

Incentives

Indicative range, as at Jun-25

The arrows indicate the direction of Cadigal’s expected change over the next 12 months.

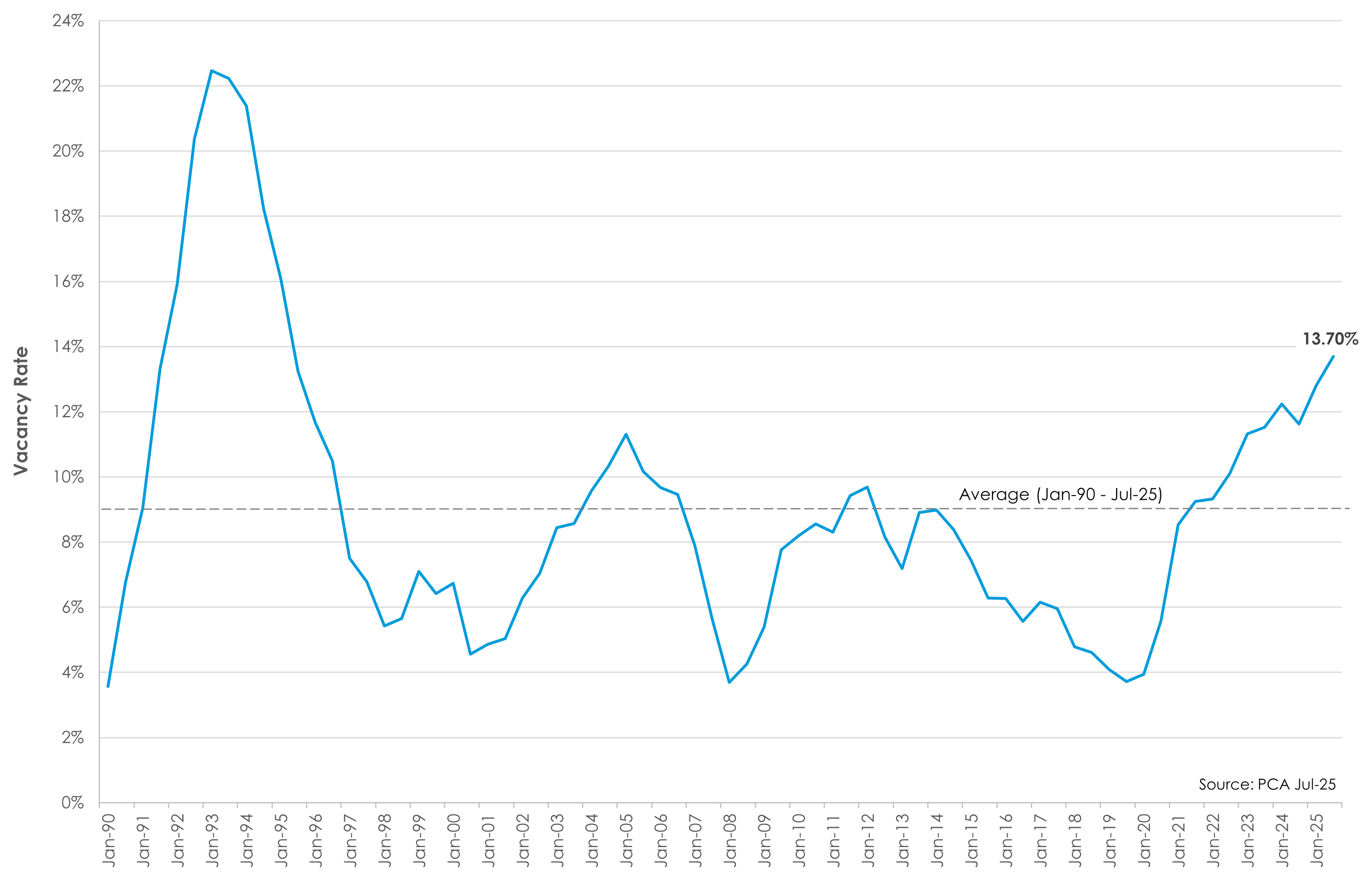

Vacancy

Rate

The vacancy rate continues to rise, increasing 0.9% over H1 2025, to 13.7%. As a result, the current vacancy rate is the highest in more than 30 years (since Jan-95).

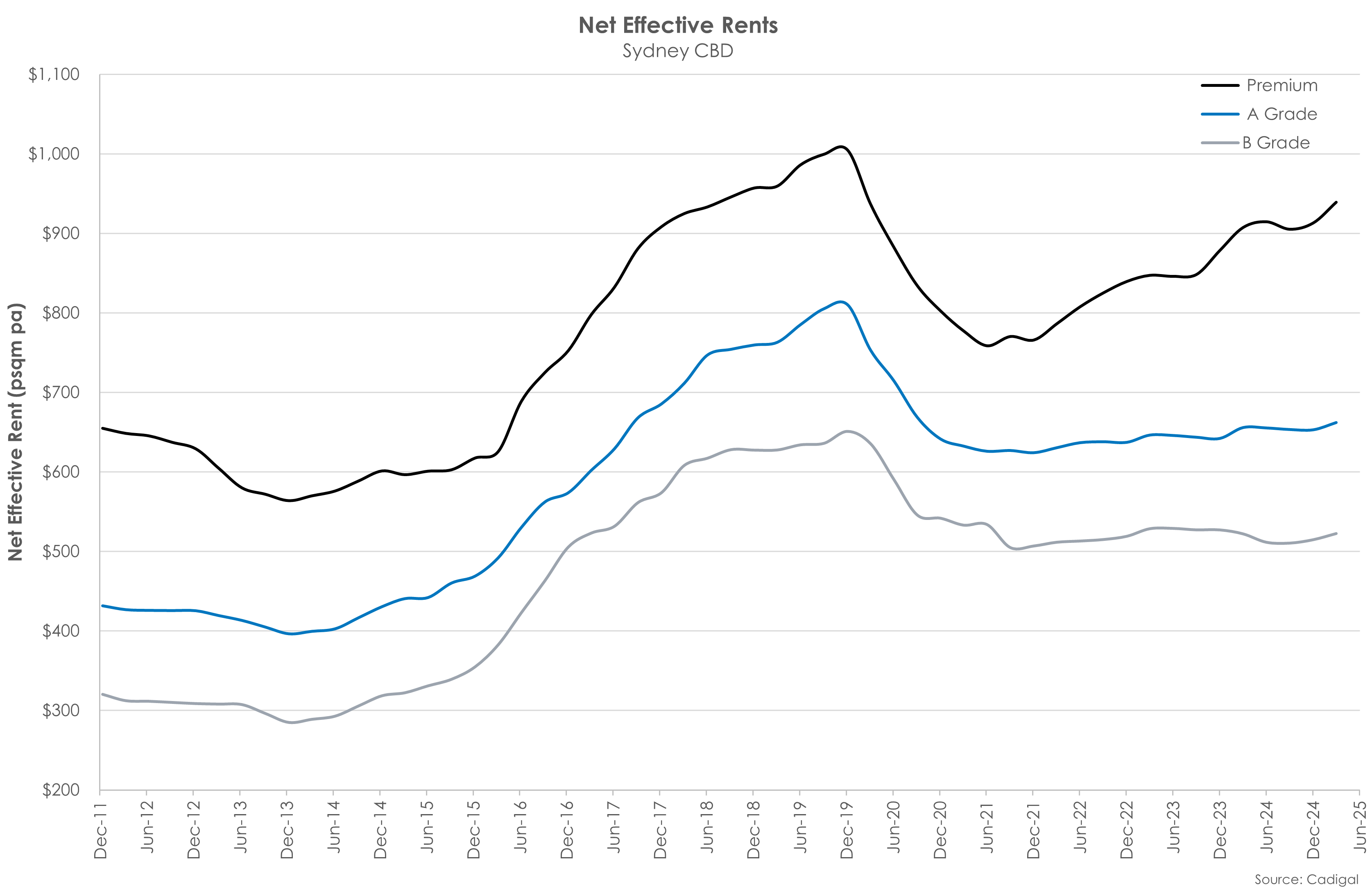

Rents

Effective rental growth has been marginally lower than face rents due to incentives being slightly higher, in general, over the last 12 months.

Effective rents rose between 1.2% and 3.6%, led by Premium grade.

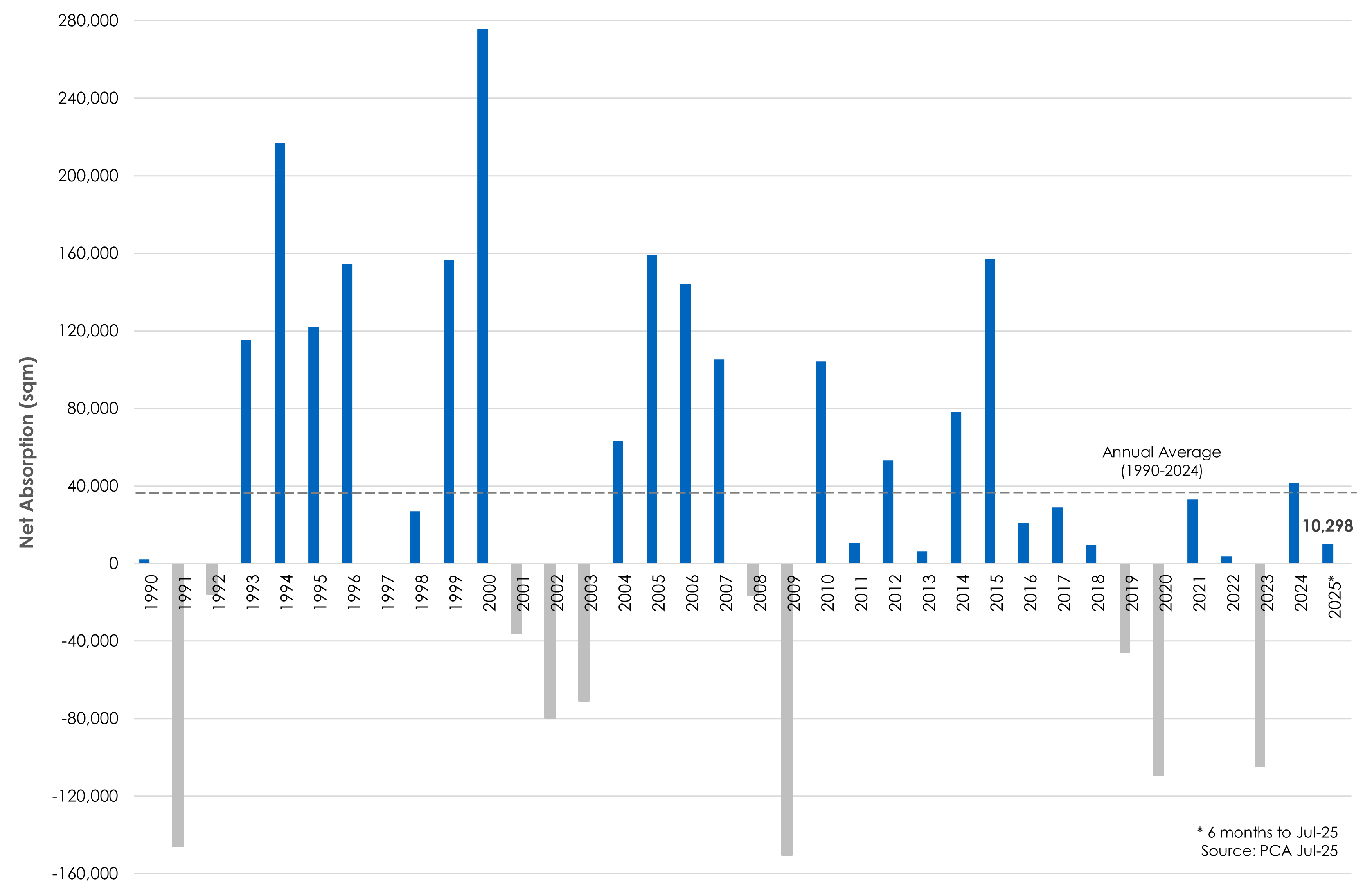

Tenant Demand

Net Absorption

10,298sqm of net absorption was recorded across the market over the first half of the year, leading to a 12-month total of 56,532sqm which is above the long-term annual average of 37,514sqm.

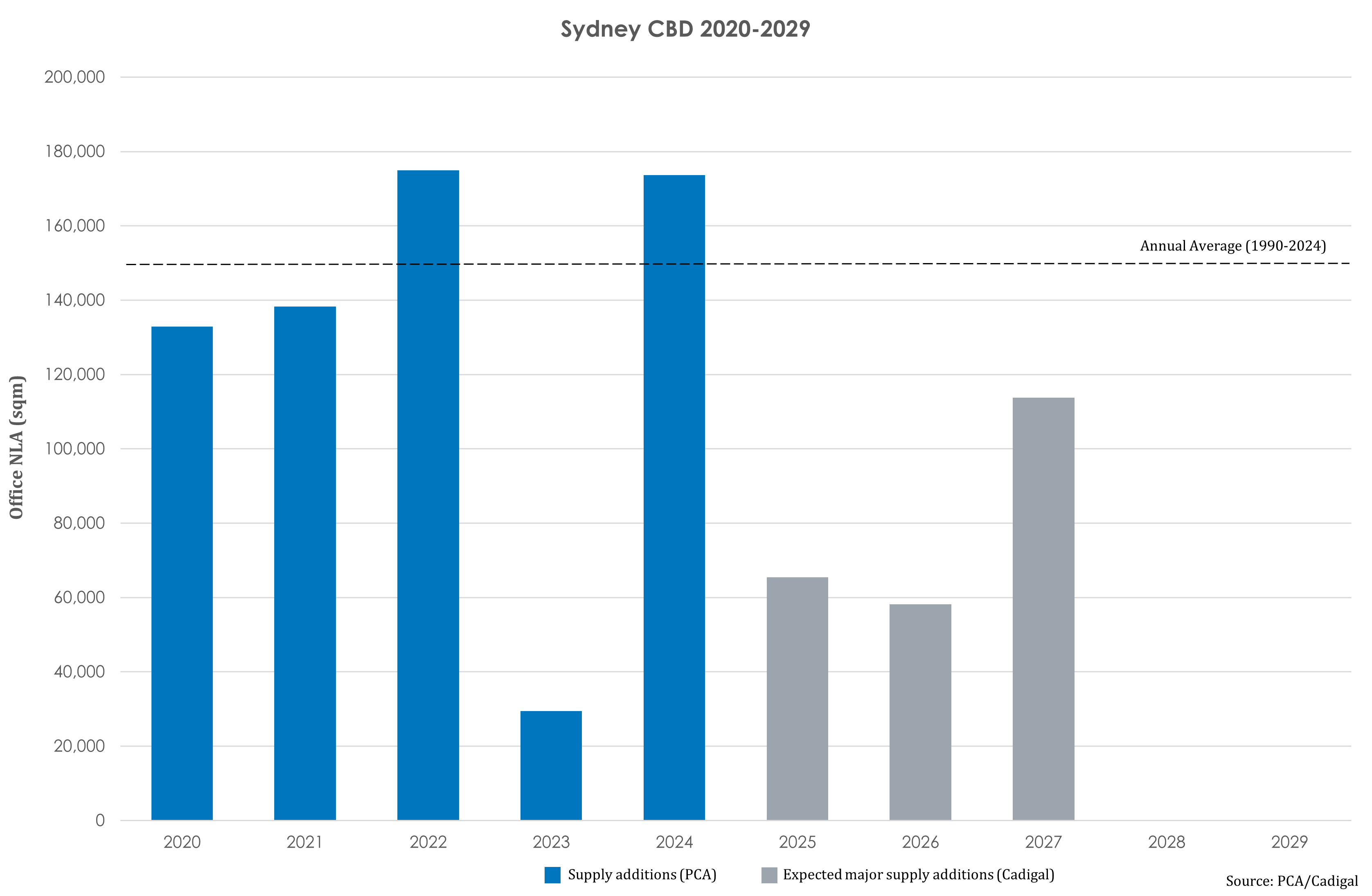

Supply Completions

2020-2029

There have been three major office projects completed in 2025 - 33 Alfred Street (31,247sqm), 121 Castlereagh Street (11,503sqm) and 270 Pitt Street (22,669sqm).

No more supply will complete in the CBD until Atlassian Central is delivered in Q4 2026, followed by Chifley South and 55 Pitt Street in 2027. After 2027, no new office supply is expected until 2030.

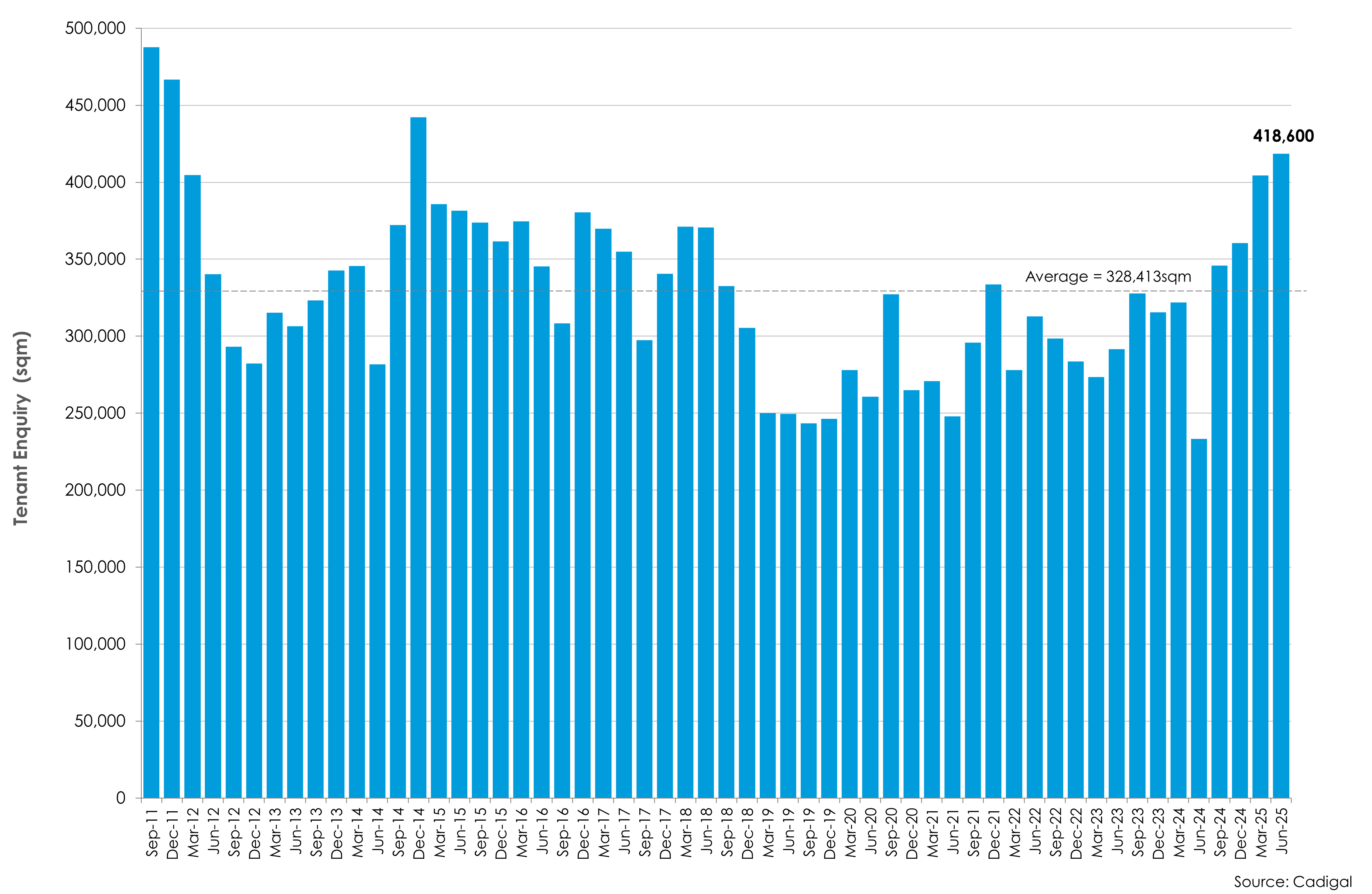

Tenant

Enquiry

The volume of active tenant enquiry continues to grow, with the 418,600sqm total the highest since Dec-14, albeit it includes Westpac’s super-sized 150,000sqm enquiry.

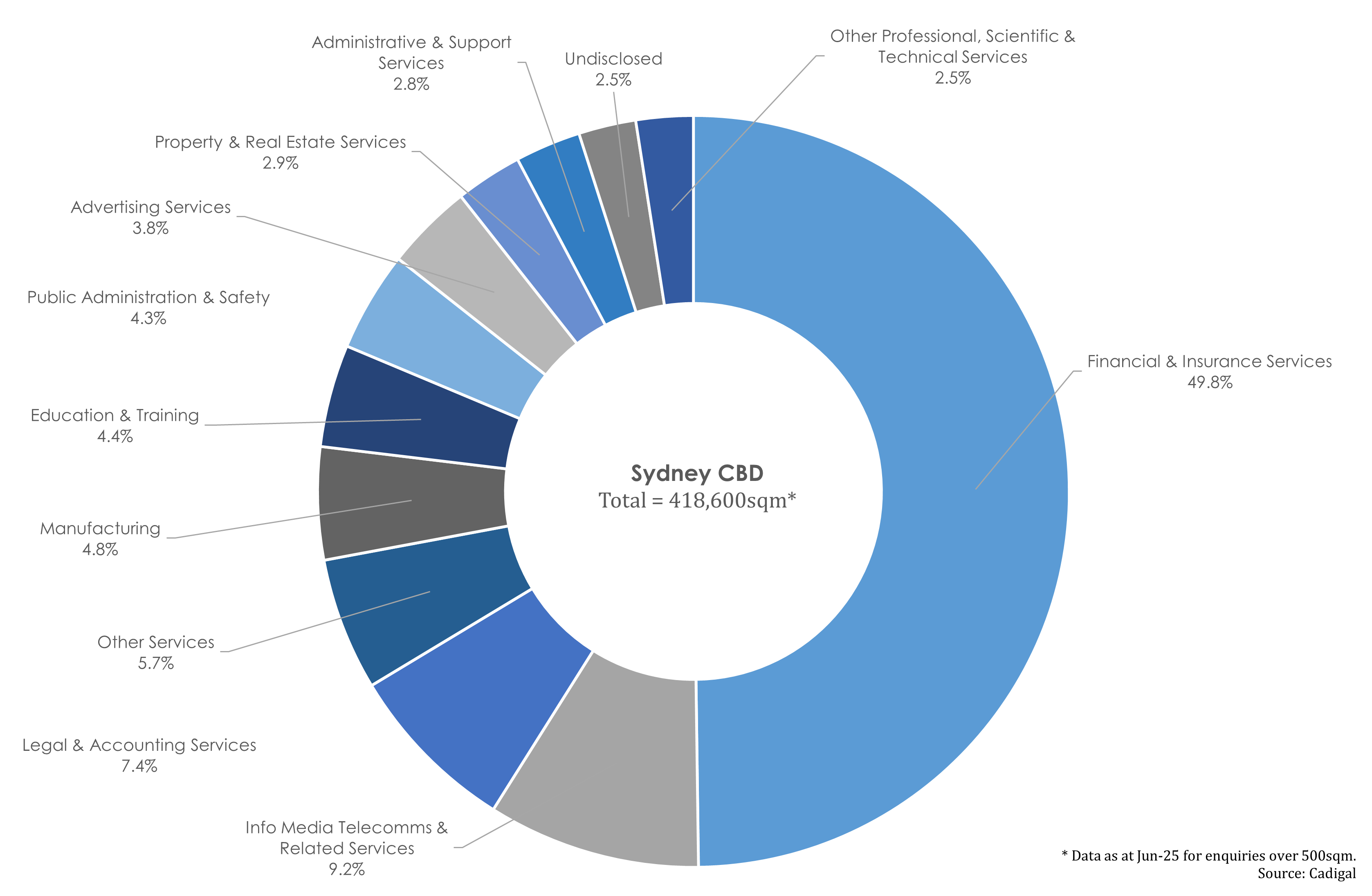

Tenant Enquiry

by Industry Sector

Half of the total enquiry is currently coming from Financial Services tenants (skewed by the Westpac enquiry), with Information Media, Telecommunications & Related Services and Education & Training rounding out the top three industries.

North

Shore

21.7%

Vacancy Rate

North Sydney, as at Jul-25

-20,250

Net Absorption

North Shore, 12 months to Jul-25

-2.1%

Rental Growth

North Sydney A Grade net effective, 12 months to Jun-25

34%-47%

Incentives

North Shore indicative range, as at Jun-25

The arrows indicate the direction of Cadigal’s expected change over the next 12 months.

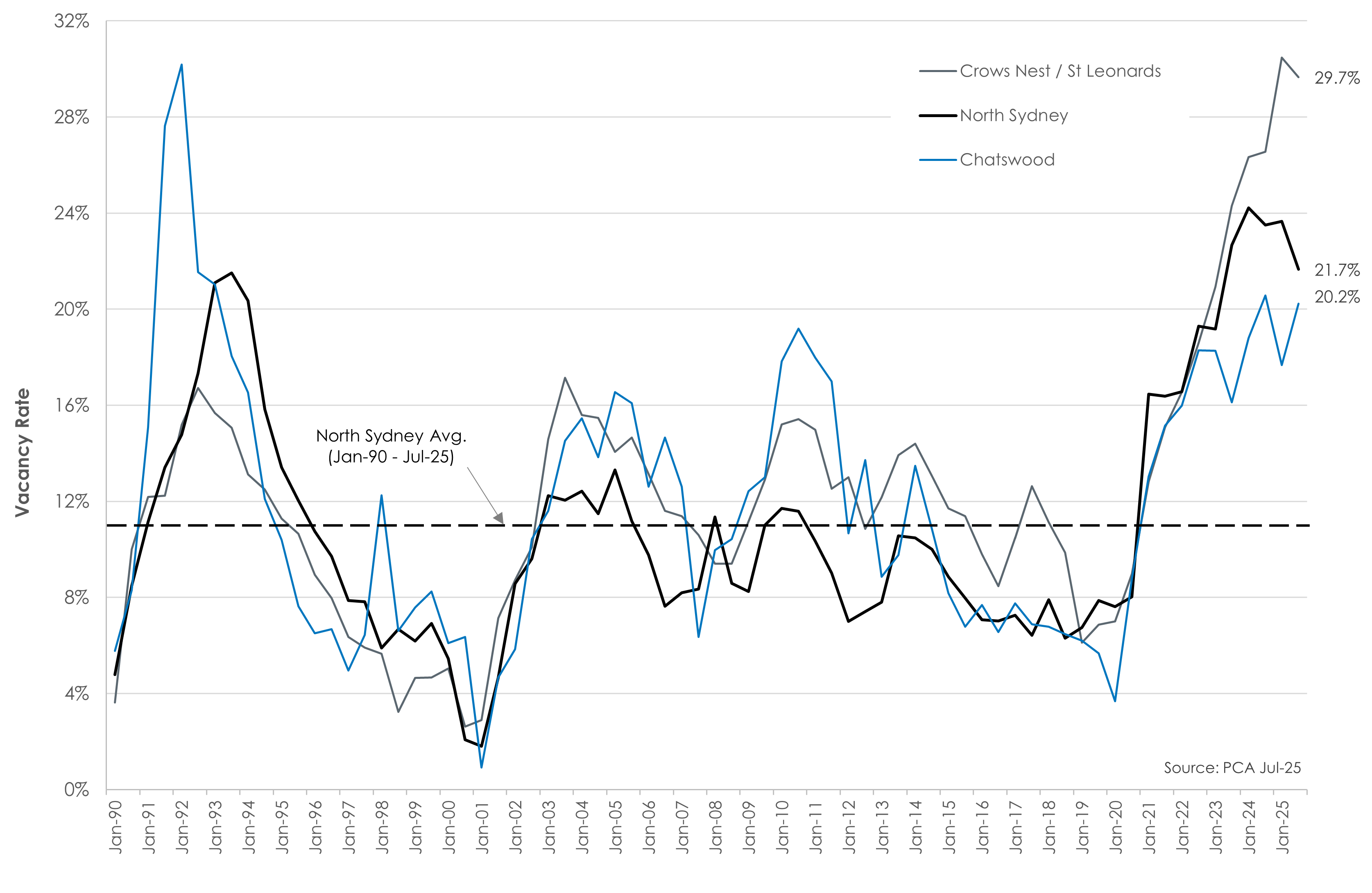

Vacancy

Rate

The overall North Shore vacancy rate fell over H1 2025 as did the largest sub-market, North Sydney from 23.7% to 21.7%, its lowest level in 2.5 years.

However, the fall was entirely driven by the withdrawal of 105 Miller Street from stock, and not tenant demand.

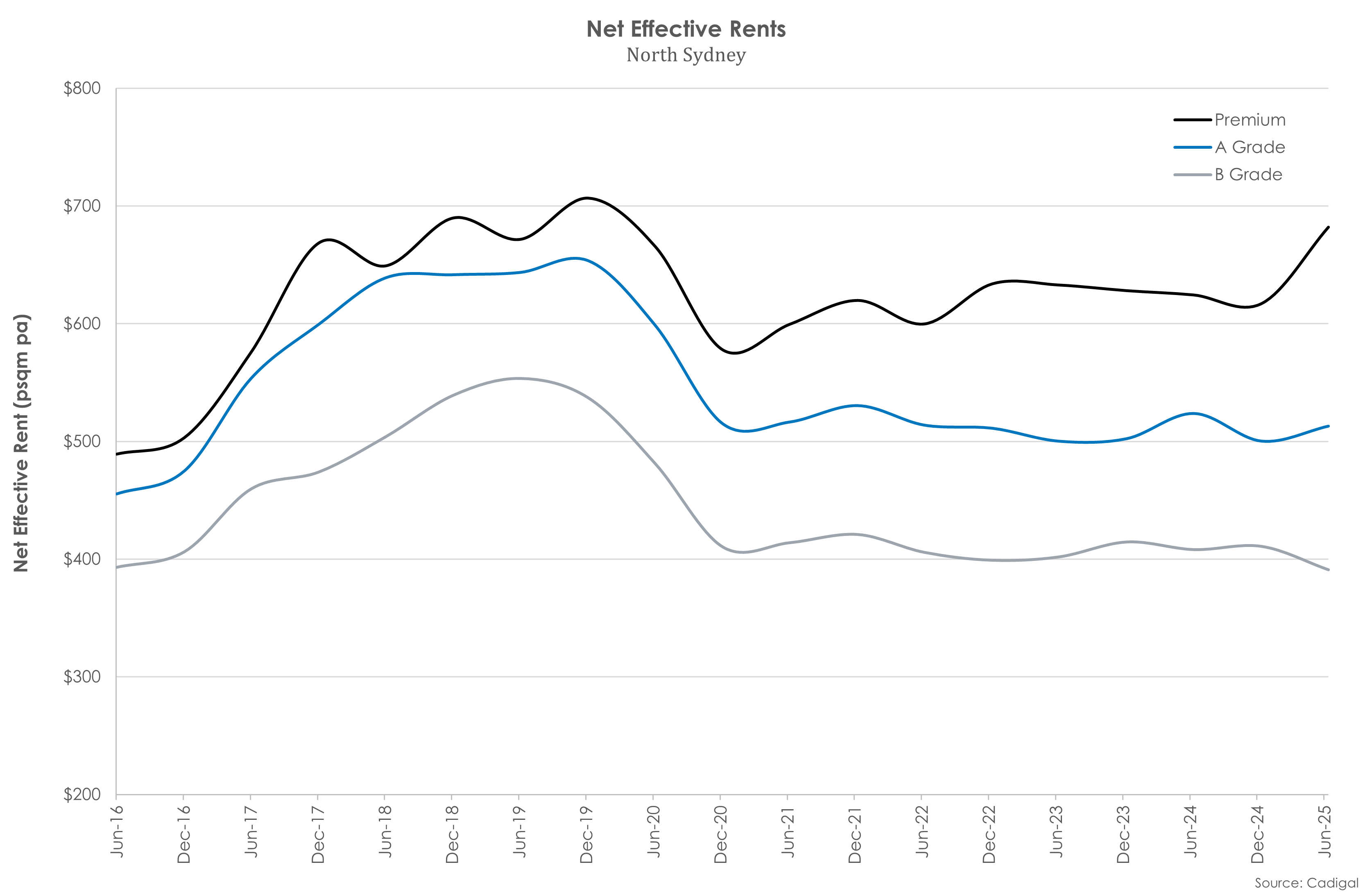

Rents

The varied performance of effective rents continued across the North Shore, resulting in an even wider range for effective rental growth of -4.2% to +9.3% over the 12 months to Jun-25, again led by Premium.

Tenant Demand

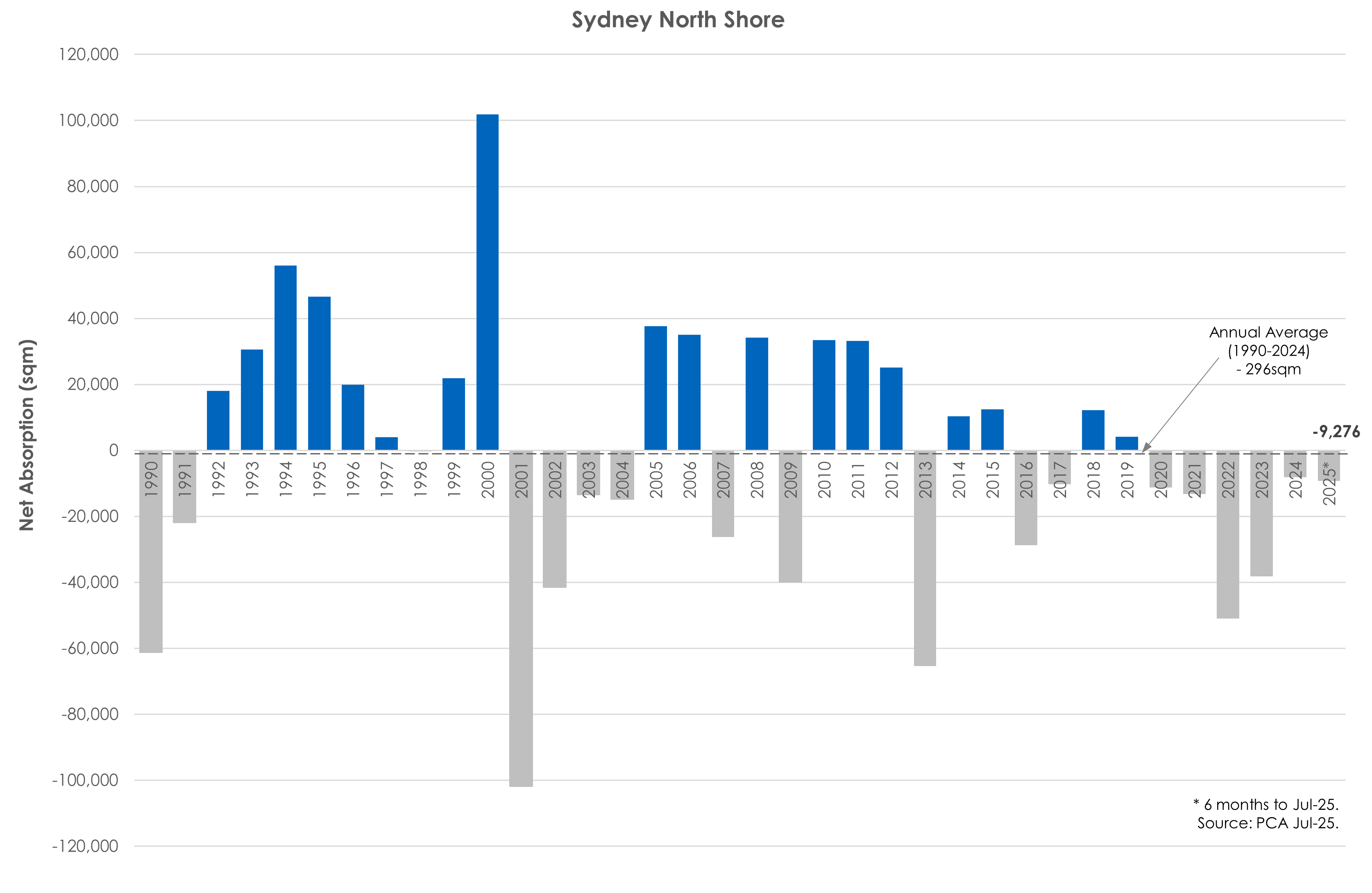

Net Absorption

Negative net absorption (-9,276sqm) was recorded on the North Shore over H1 2025 and a significant turnaround is required in H2 2025 to avoid an unprecedented sixth consecutive year of negative net absorption.

Supply Completions

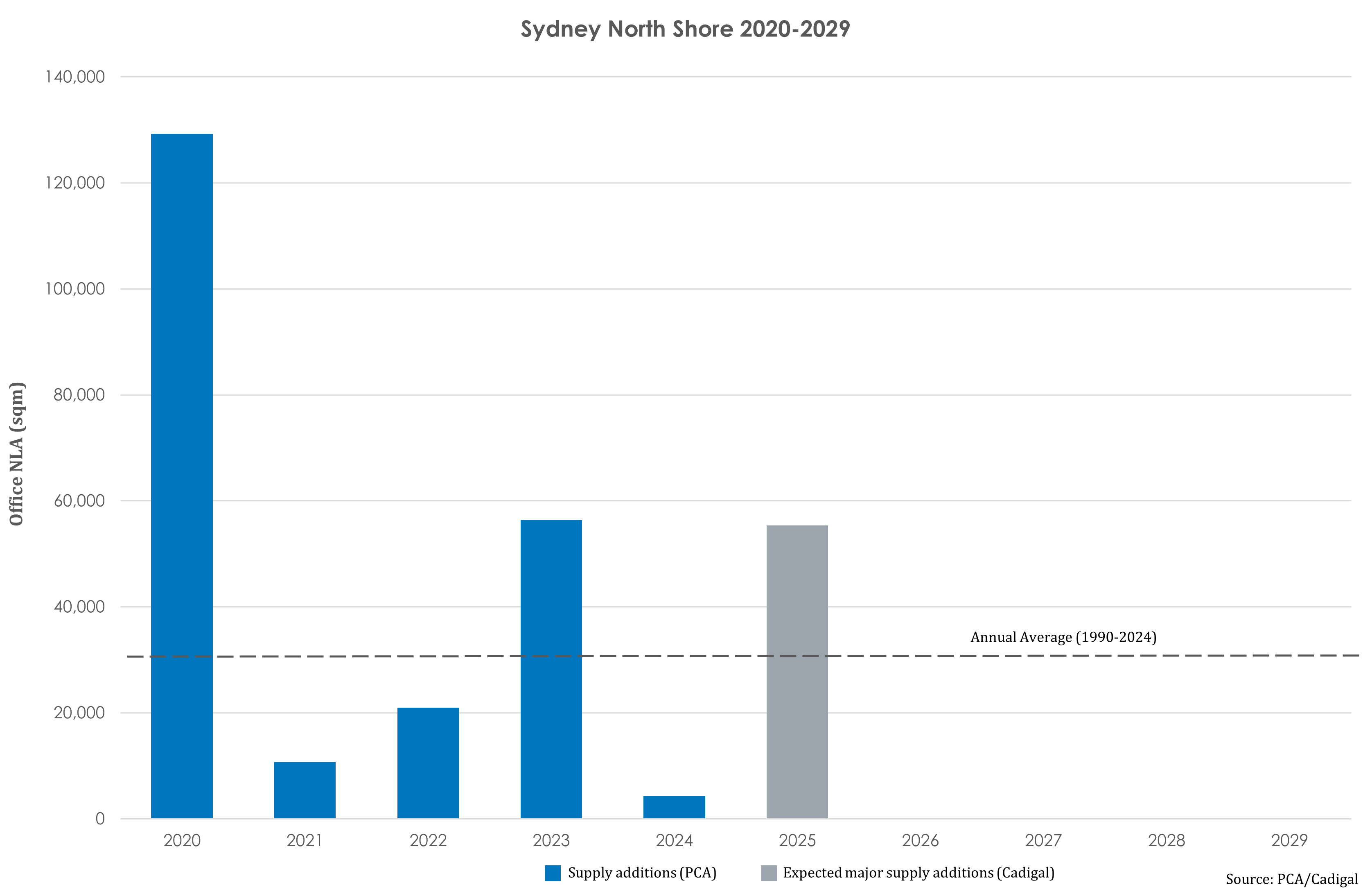

2020-2029

One major office project is currently under construction on the North Shore – Victoria Cross Tower in North Sydney (55,318sqm NLA, due Q4 2025).

No additional new supply can be delivered to the market until after end-2028, at the very earliest.

Tenant

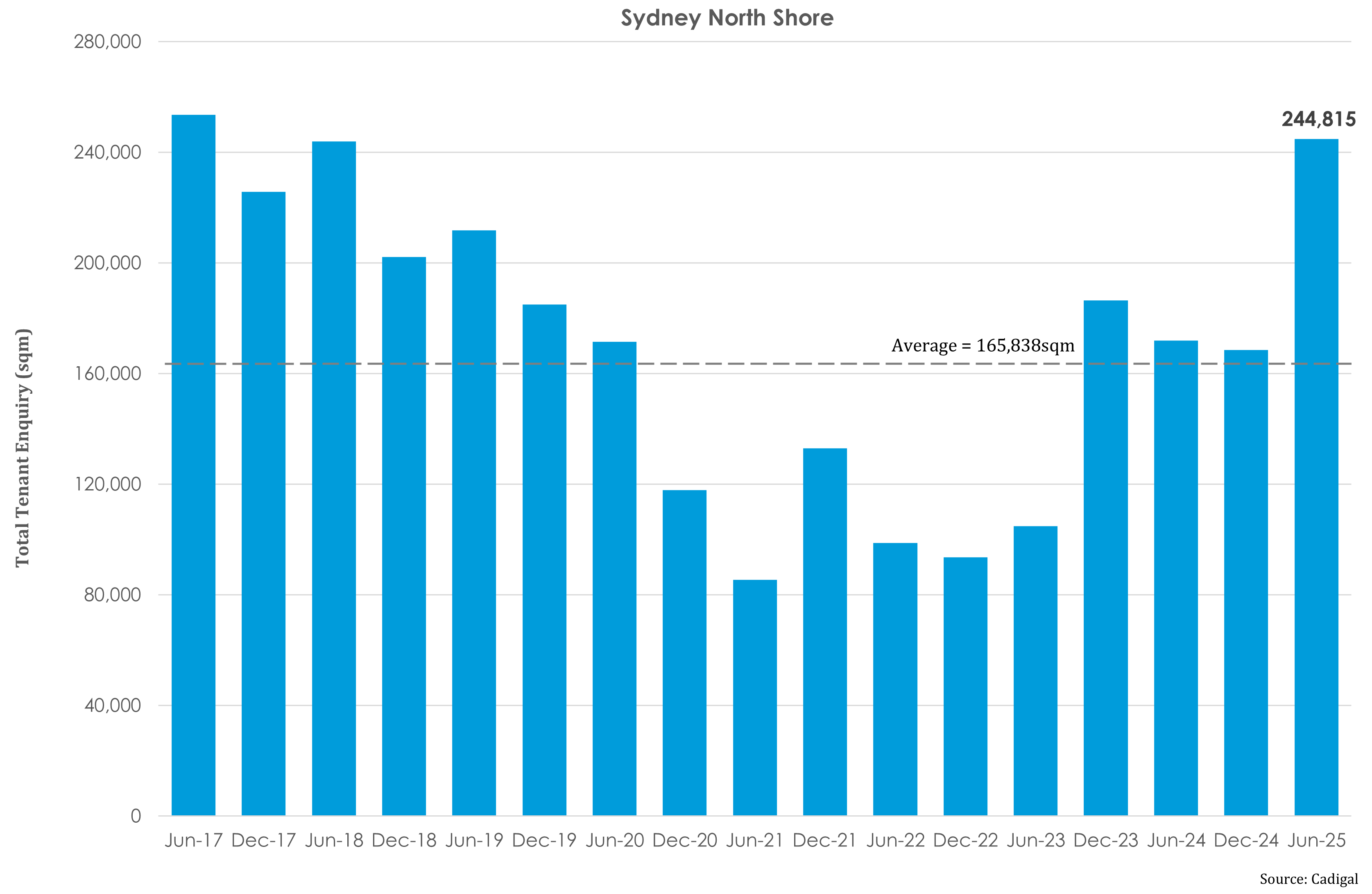

Enquiry

The volume of active tenant enquiry for the North Shore jumped 45% over H1 2025 to the highest level since Jun-17.

The huge bounce-back in enquiry has led to considerable optimism, and expectation, that net absorption will similarly improve.

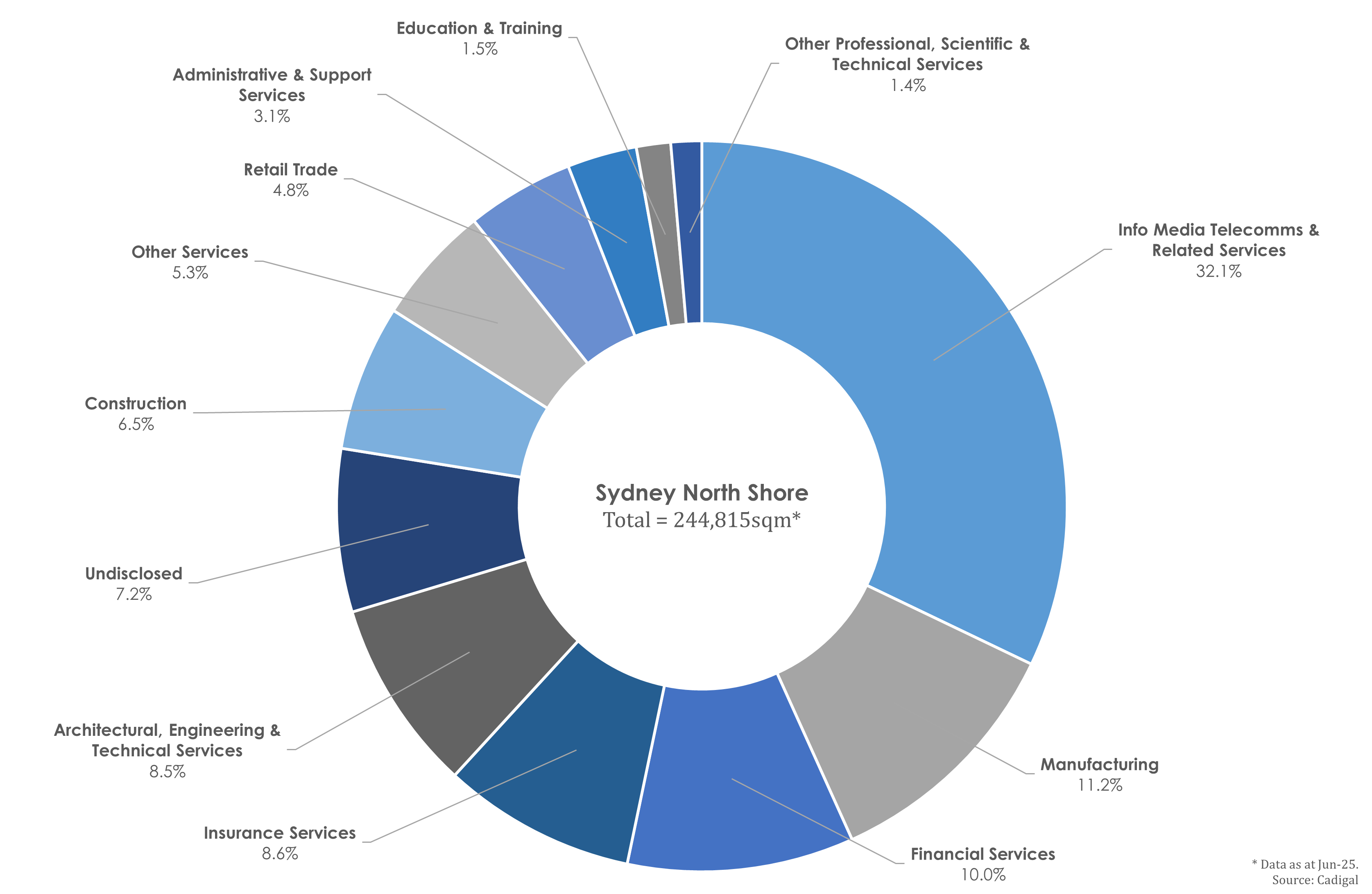

Tenant Enquiry

by Industry Sector

Information Media, Telecommunications & Related Services tenants are dominating current enquiry with almost a third of the total, whilst Manufacturing and Financial Services are the only other industries contributing 10% or more.